CBAM: an overview

The Carbon Border Adjustment Mechanism (CBAM) is a new tax for importers of emission-heavy goods, designed to combat carbon leakage within the EU. When a regulated commodity is imported, carbon credits must be purchased

By introducing the CBAM, the European Union is able to offset embedded carbon emissions on imports to bring foreign goods up to the same regulations that domestic manufacturers have to meet. This prevents companies from simply switching to third-country suppliers to avoid emissions regulations.

Once the Carbon Border Adjustment Mechanism has completed its implementation, it is expected that it will cover more than 50% of emissions for ETS-covered goods. Currently, the commodities that will be covered are:

- Cement

- Iron and steel

- Aluminium

- Fertilisers

- Hydrogen

- Electricity

CBAM will be introduced over two phases:

CBAM transition (reporting) stage

From 1st October 2023 until 31st December 2025, you are only required to submit CBAM reports for every quarter. These must be completed within a month from the end of the quarter, with your first report due by 31st January 2024.

Carbon Border Adjustment Mechanism certificates are not required to be purchased during the transition phase.

CBAM operational stage

The full Carbon Border Adjustment Mechanism will be in effect from 1st January 2026. Annual declarations are required, either directly or through a CBAM-authorised declarant. If you complete the declaration directly, you must be CBAM-authorised.

Your first annual declaration is required by 31st May 2027.

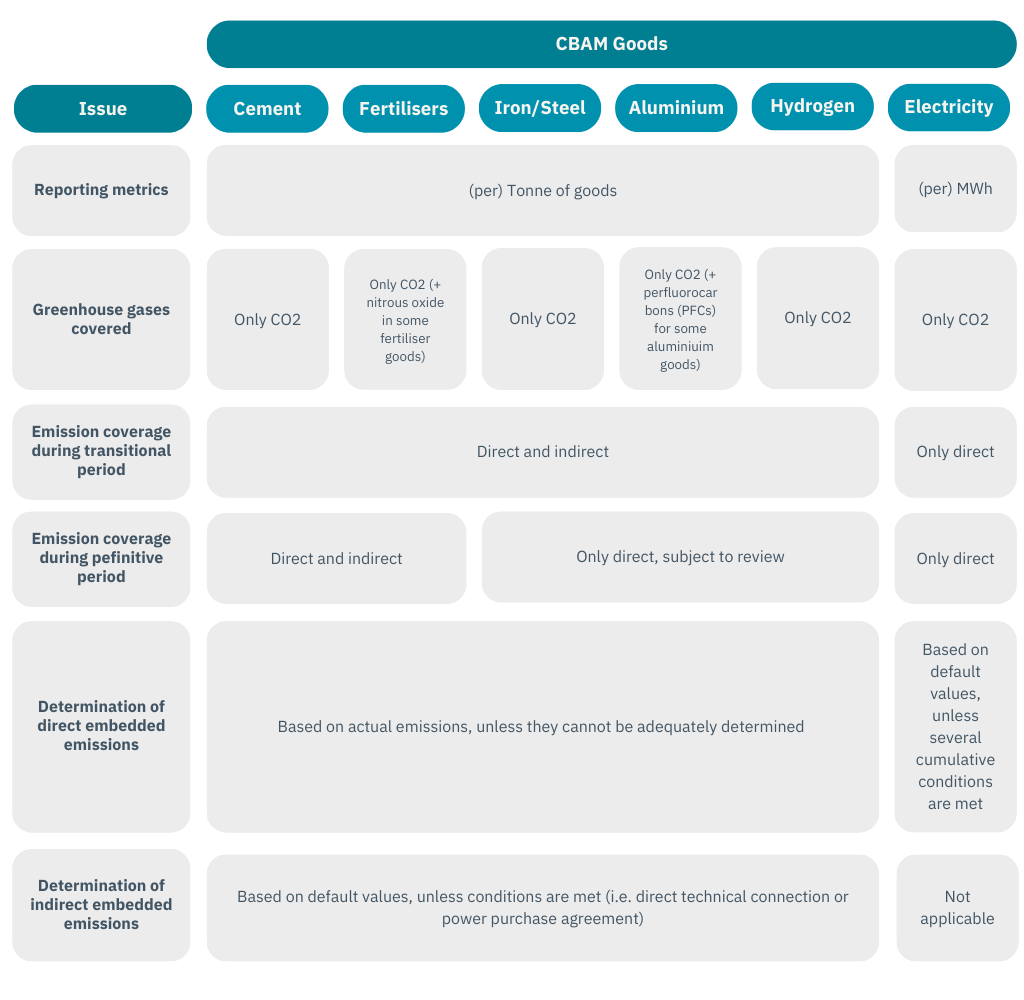

What details must be included in my CBAM reports?

A recent memo from the European Commission indicates that your CBAM report must include the following commodity and emission information:

Table from European Comission

Additionally, the following must be declared on your CBAM report:

- Country of origin

- Production methods

- Identification number of the mill (for metal goods)

- Whether exact or default values were used for calculating emissions

- If any carbon price has already been paid in the country of origin

Check your country to see if your CBAM reporting is a customs or tax responsibility

Although the Carbon Border Adjustment Mechanism is applied to imports, some EU countries have allocated resources from tax departments to oversee CBAM-related activities.

What’s next?

The Carbon Border Adjustment Mechanism Committee will collect feedback on the proposed regulations before confirming or amending them in the coming months.

Meanwhile, it is best for you to collaborate with your suppliers to get paperwork practices in place that provide the right information, and establish which values will be used for emissions.

Do you need to submit CBAM reports?

Customs Support is a neutral provider of customs services across the EU, helping businesses like yours navigate the ever-changing landscape that is customs. For guidance in preparing for CBAM-reporting, contact us for more information.